- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Is Tractor Supply Stock Underperforming the S&P 500?

/Tractor%20Supply%20Co_%20storefront%20by-%20TennesseePhotographer%20via%20iStock.jpg)

With a market cap of $32.1 billion, Tractor Supply Company (TSCO) is the largest rural lifestyle retailer in the United States. The company serves recreational farmers, ranchers, pet owners, tradesmen, and rural communities with a wide range of products, including livestock and equine feed, companion animal care, hardware, tools, seasonal goods, and workwear.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Tractor Supply fits this criterion perfectly. Operating under the Tractor Supply, Petsense by Tractor Supply, and Orscheln Farm and Home brands, it also offers exclusive private-label products across its stores and online platforms.

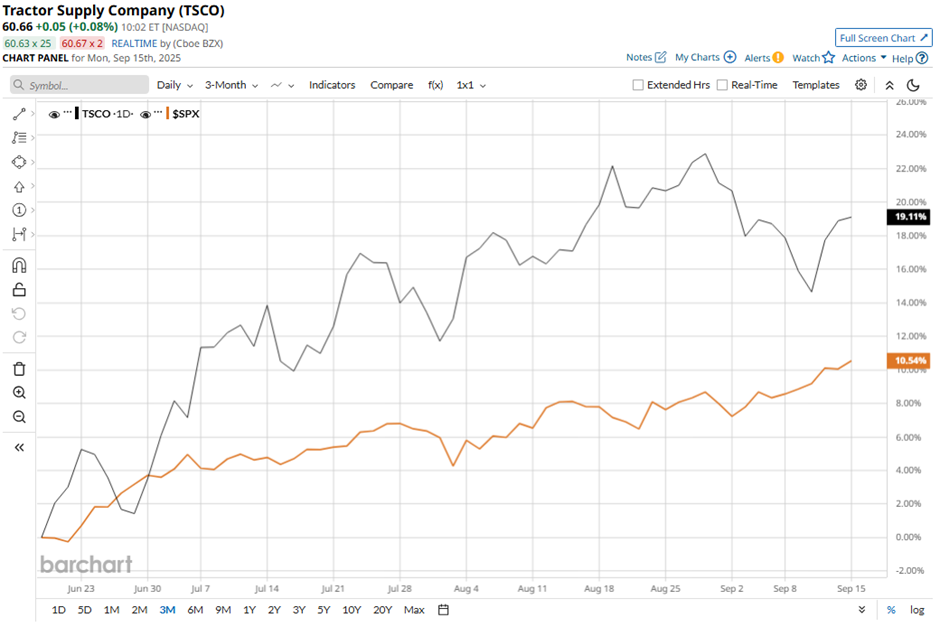

Shares of the Brentwood, Tennessee-based company have fallen 5.6% from its 52-week high of $63.99. Tractor Supply’s shares have returned 17.2% over the past three months, outperforming the broader S&P 500 Index’s ($SPX) 10.5% increase over the same time frame.

In the longer term, TSCO stock is up 13.8% on a YTD basis, slightly outpacing SPX’s 12.3% gain. However, shares of the retailer have risen 6.7% over the past 52 weeks, lagging behind the 17.4% return of the SPX over the same time frame.

Yet, the stock has been trading above its 50-day moving average since early June. Also, it has remained above its 200-day moving average since July.

Tractor Supply reported better-than-expected Q2 2025 EPS of $0.81, while revenue grew 4.5% to $4.4 billion on Jul. 24, driven by a 1.5% increase in comparable store sales and contributions from 24 new store openings. Investor confidence was supported as the company reaffirmed its fiscal 2025 sales and profit targets, with resilient demand for essential products like livestock feed and pet food. Despite the solid results, TSCO shares fell marginally on the day.

In contrast, rival Williams-Sonoma, Inc. (WSM) has lagged behind TSCO stock on a YTD basis, gaining 6.6%. Nevertheless, WSM stock has surged 36.6% over the past 52 weeks, outpacing TSCO’s performance during the same period.

Despite the stock’s underperformance over the past year, analysts remain moderately optimistic on TSCO. The stock has a consensus rating of “Moderate Buy” from the 31 analysts in coverage, and the mean price target of $63.28 is a premium of 4.5% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.